Environmentalists warn investors of deep-sea mining risk

The share price of The Metals Company fell by 90% in the 12 months following its Initial Public Offering and major investors are abandoning it, but those are not the only reasons for investors to steer clear of deep-sea mining, according to warnings from the Environmental Justice Foundation. Investing in deep-sea mining should be seen as extremely high-risk given threats to biodiversity, unpredictable demand, unproven technology, the risk of litigation and reputational risk.

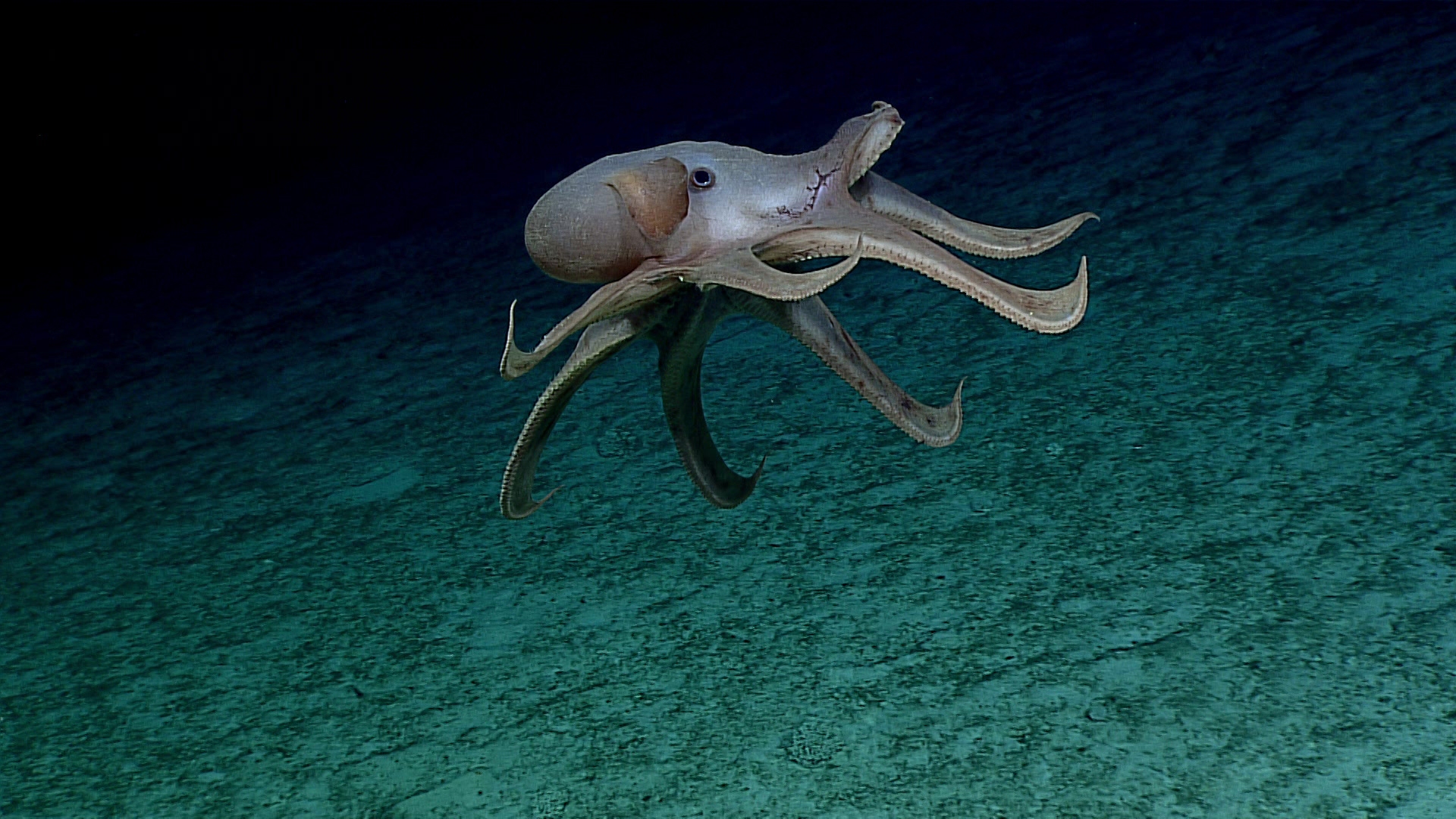

Research shows that the adverse impacts on biodiversity from deep-sea mining (DSM) are likely to be severe and long-term, and environmental impact assessments are unreliable. Biodiversity is increasingly mainstream in investor decision-making, with 126 financial institutions representing 21 countries and over 18.8 trillion euros in assets signing the Finance for Biodiversity Pledge, committing to protect and restore biodiversity through their activities and investments. Investing in DSM is clearly contrary to this, says EJF.

According to the briefing, DSM would also likely not be compliant with the International Finance Corporation’s Performance Standard 6, providing guidance on biodiversity conservation. Such investments may run up against biodiversity-related disclosure requirements in the future should more nations join France in adopting them.

Jan Erik Saugestad, CEO, Storebrand Asset Management, said: "We have to remember that the deep sea is really one of the very few pristine ecosystems remaining, and to just open up for exploitation without insight is close to madness. There is increasing recognition that biodiversity loss is a true financial risk and something we have to consider when we make all investments."

DSM threatens key ocean carbon sequestration mechanisms. 26 years after a simulated mining disturbance, the amount of carbon stored in marine fauna and going through the food chain remained just over half the values observed in undisturbed areas. Social risk is added by the probable severe impact on fisheries, according to the briefing, with key tuna fisheries for small island nations overlapping with potential DSM sites.

The briefing suggests this is not offset by a positive financial outlook. The technology is unproven, requires extensive capital and operational expenditure, and the timescales for the industry to become active may not align with demand for its outputs. Even under the most ambitious renewable energy transition scenario, demand for key metals can be met without mining the deep sea. Future demand is also likely to be affected by innovation in battery technology; the market share of batteries which require neither cobalt nor nickel rose to 31% in September 2022 from 17% in January 2021.

Johanna Schmidt, Investment Strategist, Triodos Investment Management, said: “As a prudent and precautionary investor, we just simply do not want to take the risk and also want to call on the financial industry to join us in this. There may be permanent and irreversible risks to deep-sea ecosystems. As such, I think the financial sector should join us in excluding DSM from their financing and investment activities.”

Lockheed Martin, the biggest corporate backer of DSM, recently exited the industry, as did Maersk, another major investor. The Metals Company (TMC) has received repeated NASDAQ delisting notices. TMC is also currently facing two lawsuits from investors, who allege the company made false and misleading statements. Lastly, given the broad spatial scope of the effects of DSM, litigation risk extends to the environmental impacts of DSM upon third parties.

There is a clear reputational risk associated with DSM, the briefing says, given ever-more companies including BMW, Volkswagen, Samsung and Google have committed not to purchase minerals mined from the deep seabed. State opposition is growing, with national commitments to a ban or precautionary pause increasingly common. UN organisations have highlighted operational, regulatory, and reputational risks, stating there is "no foreseeable way in which the financing of deep-sea mining activities can be viewed as consistent with the Sustainable Blue Economy Finance Principles.”

Steve Trent, CEO and Founder of the Environmental Justice Foundation, said: “It is clear that DSM has nothing to offer investors, and plenty to trouble them. The financial insecurity of DSM companies, the significant risks they expose investors to, and the fundamental incompatibility of DSM with sustainable investing sends a clear signal. If you stay away from DSM, you’ll be protecting the bottom of the ocean and your bottom line.”

ENDS

Notes to editors

The full briefing can be read here.

To date, no commercial deep-sea mining has been carried out. However, this could soon change, as applications for exploitation contracts can be submitted to the International Seabed Authority (ISA) as early as July this year.

Litigation currently faced by TMC includes the allegation that TMC failed to “adequately warn investors of the regulatory risks faced by TMC’s environmentally risky exploitation plans”.

The Environmental Justice Foundation (EJF) exists to protect the natural world and defend our basic human right to a secure environment. www.ejfoundation.org

For more information contact:

EJF Press Office

Image credit: NOAA Office of Ocean Exploration and Research.

SIGN UP FOR OUR EMAILS AND STAY UP TO DATE WITH EJF